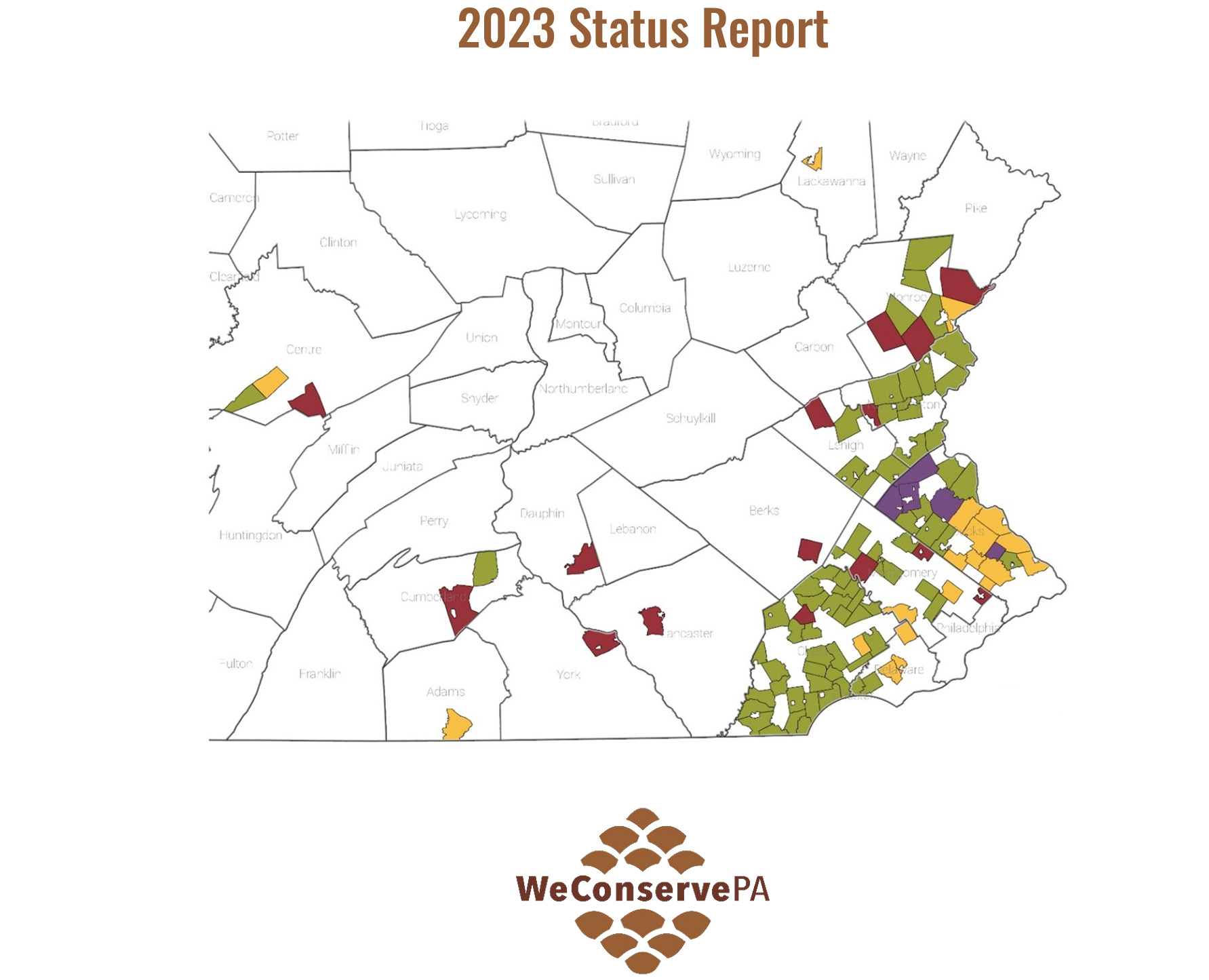

WeConservePA analyzed and applied geographic information to LandVote data to produce the Local Municipal Open Space Referendums in Pennsylvania: 2023 Status Report. It includes numerous maps and charts describing the 157 open space referendums offered to voters at the local municipal level between 1996 and 2023.

Pennsylvania Act 153 of 1996 (“Open Space Lands, Acquisition and Preservation”) authorizes local governments (excluding counties) to establish earned income and real estate taxes specifically dedicated to the acquisition of land and easements for the purpose of providing open space benefits.1 Such taxes are established through voter referendum. The voter-approved taxes may exceed the standard limits on tax rates placed on local government. Under separate statutory authority, local governments may also borrow money (including issuing bonds) to fund open space acquisitions. This borrowing may occur with or without voter approval depending on circumstances.

In this report, WeConservePA reviews the voting outcomes of and monies generated by these open space tax and bond referendums. In providing analysis, the report draws heavily on data accessed from The Trust for Public Land’s LandVote database through January 2024.